True Wealth Requires Thinking Differently

Alpha Omega Wealth has financial professionals across the United States who are trained to help you achieve financial independence and lasting success through strategies designed to maximize your wealth.

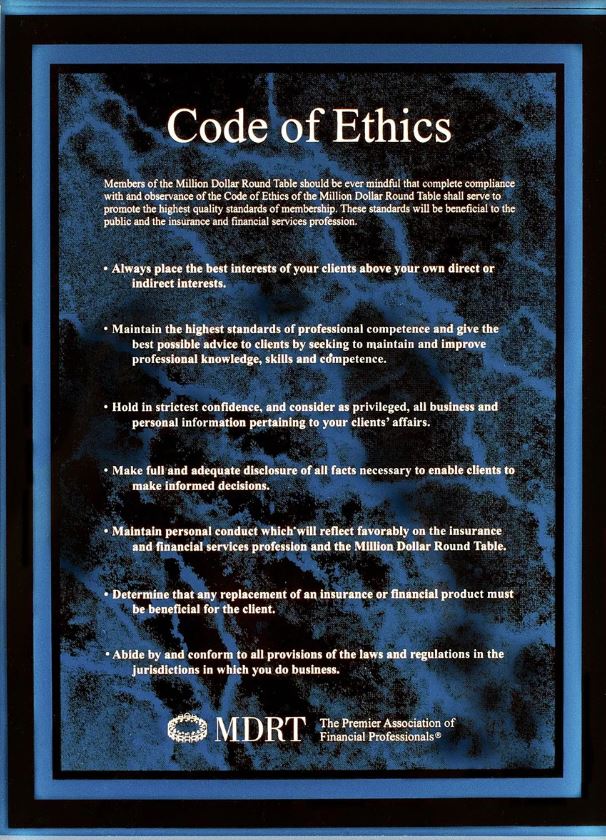

We empower our clients to break free from the cycle of debt and consumerism by providing life-changing insights, fostering financial literacy, and providing guidance toward true financial freedom with integrity.

Isn’t it time to take control?

Make Your Wealth Work Podcast

How wealth becomes your greatest ally.

Financial Freedom Comes From Knowledge & Control

Explore Our Educational Video Library

- Taking Control of Your Personal Economy

- Overcoming the Human Element

- Compound Interest and the Velocity of Money

- Leave a Legacy of Wealth with Wisdom